Insights for Providers

Jul 19, 2024

Insights for Providers | September 21, 2023

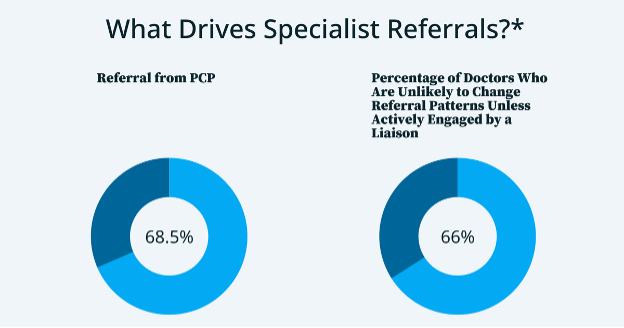

Most healthcare providers’ priorities include retaining patients and improving referral patterns to increase revenue. As hospital CFOs and CSOs seek to improve their top line, they are paying particular attention to the journeys of the patients in their care; where they get referred in from, and where they may eventually get referred out to. It is estimated that the average hospital loses 10-30% of its potential revenue to patient referral leakage (when a patient seeks or is referred to care outside of the hospital network), causing $200 to $500 million in losses per year.1 Therefore, understanding the reasons for leakage and keepage (when services are kept and rendered within the system) is a critical need for hospitals and health systems to avoid revenue loss. Many are turning to more robust data-driven strategies supported by advanced analytics to optimize the impact of teams accountable for improving the flow of patients into and through their networks of providers. Business development and physician liaisons are two primary functions that focus on minimizing leakage and maximizing keepage. These teams are responsible for fostering growth and strengthening relationships with physicians. To meet their strategic goals, they need to understand the factors that drive specialist referrals so they can clearly identify the root causes of out-of-network referrals and thus, lost revenue. Research over the last 10 years demonstrates that referrals by primary care physicians (PCPs) will most likely drive the specialist care that a patient receives. It also shows that doctors are unlikely to change their referral patterns unless they are actively engaged by a physician liaison team member. This is why the use of granular analytics and the strategic deployment of a physician liaison go hand in hand. *Sources of the Statistics Listed Above in ‘What Drives Specialist Referrals?’ For most health systems, internal data may offer some insight into specialist referral patterns, but they will only provide a partial picture. External market and referral level insights that are inclusive of claims across all payers and care settings provide a more comprehensive view of where leakage may be occurring, which physicians are contributing to leakage, and where the best opportunities may be to recapture patients who have moved out-of-network. These are the insights that are needed for health systems to accelerate patient acquisition, increase loyalty, and strengthen relationships with referring physicians. A health system in the southeast realized a need to improve its patient acquisition, patient retention, and physician engagement strategies. Specifically, within their market, they knew that they competed with several facilities to which local physicians partnered referred patients for different types of care. But due to the limitations of their internal data, they struggled to understand how referral patterns were trending outside of their system. To better focus their business development teams and physician liaisons, the health system needed external market and referral insights to assess the entire ecosystem of provider referrals, both inside and outside of their network. Importantly, the strategy, business development and physician liaison teams needed a common source of truth for their market and referrals data. To achieve this, they evaluated different healthcare analytics and technology solutions available on the market. They chose and deployed Clarify Referrals, a cloud analytics software that uncovers the biggest areas of opportunity to improve physician alignment and pinpoints key drivers of leakage. With the solution in place, the team was able to clearly identify the physicians who were contributing to out-of-network referrals and could see the competitor groups that were attracting referrals. They followed the following key steps: As a result of these efforts, the team was able to look at all locations and quantify the revenue impact of the patient flow that was kept in-network. They were able to clearly identify opportunity vs. ROI for the team and focus their efforts on the highest-value activities. With the help of Clarify Referrals, the health system was able to build a scalable and reliable strategy that minimizes leakage, improves physician alignment, and strengthens network integrity. Addressing the challenge of patient referral leakage and physician alignment can create significant ROI for health systems. Business development and physician liaison teams play a vital role in tackling these issues and, with the right insights, they can take the necessary steps to create actionable strategies that increase keepage while creating greater patient satisfaction and loyalty. This means going beyond internal referral data and incorporating external market and referral insights through a reliable analytics partner to obtain a comprehensive and actionable view of patterns and opportunities for retaining patients. 1 https://www.mercuryhealthcare.com/faq/patient-referral-leakage#statistics

MD News: Clinical Advisory Board Physician Survey, 66 percent of participating physicians said they were “very unlikely” to change their referral patterns without a physician liaison actively communicating and visiting with them

HSC Research: Word of Mouth and Physician Referrals Still Drive Health Care Provider Choice Trends in physician referrals in the United States, 1999-2009.Case Study: How a health system in the southeast leveraged actionable patient referral data to minimize leakage and increase specialty referrals.

Leveraging the dashboards in software, the health system’s teams could see a clear overview of trends of inferred referrals from employed PCPs to in-network specialists vs. out-of-network specialists. From there, they could also access a snapshot of the competitor groups or physicians that referrals were leaking to. The software enabled them to also identify outliers that could potentially skew results, such as physician turnover or historical claims that followed a new provider to their system.

Once they established their performance metrics and could see where referrals were going, the team was able to clearly identify the PCPs that were sending the highest volume of referrals out of network and could develop a prioritized outreach strategy for physician engagement.

The team zoomed into oncology, transplant, urology, ENT, bariatric, women’s, children’s, heart and vascular, orthopedics, and neurosciences service lines, identifying 76 physicians across 18 different groups.

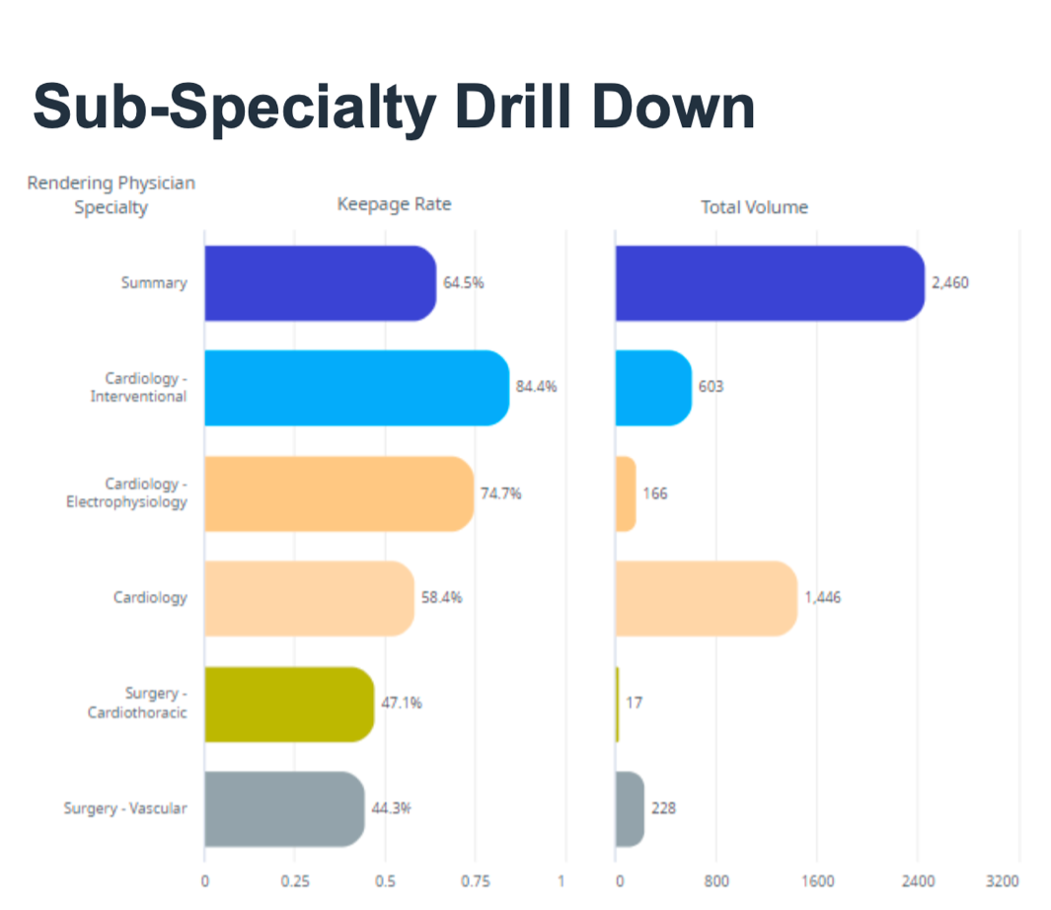

By digging into service lines and subspecialties, they could share information about specific referral patterns with service line representatives and physician liaison teams to develop a targeting strategy to increase physician alignment. For example, as shown in the chart below, they were able to see the keepage rates and total volume by the Cardiology subspecialty. This information was shared with senior management and service line administrators so they could clearly track how referrals were trending quarterly toward their goals.

Conclusion