Insights for Providers

Jul 19, 2024

Insights for Providers | September 7, 2022

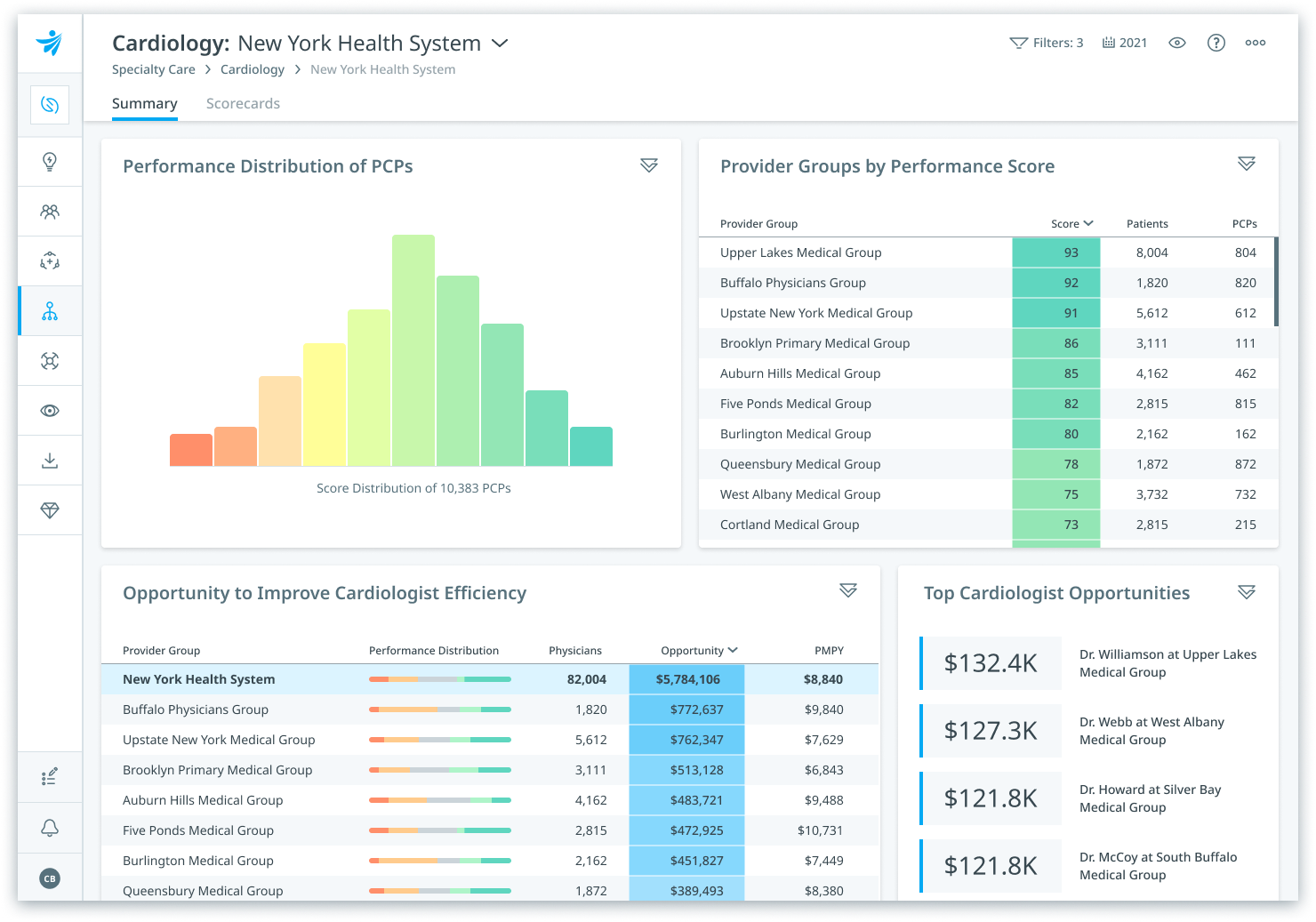

Among health systems predominantly operating within the traditional fee-for-service (FFS) context and those engaging in risk-based contracts, uncovering opportunities to drive higher-value care is a constant refrain. Health systems are increasingly being measured on quality metrics by payers seeking to tailor narrow networks and by consumer preferences driven by Leapfrog and the Centers for Medicare & Medicaid Services (CMS) Star Ratings. There is heightened competition from non-traditional actors, like Amazon (with its acquisition of One Medical), a continuous push from government and commercial payers to accept greater financial risk, and an increase in consumer-directed care decisions. Improving provider network integrity and optimizing referral patterns can be a highly effective strategy to not only increase in-network volume, but to increase value, too. However, success requires robust analytics and the right insights to evaluate and optimize referral patterns alongside provider performance. Health systems planning to remain in FFS will still be measured by payers seeking to design narrow provider networks regardless of their participation in at-risk arrangements. As payers continue to steer patients for shoppable services, value demonstration has become table stakes for retaining and attracting volume. Put simply, market share growth increasingly depends on payer network inclusion, which is determined by perceived provider network quality and efficiency. Only those providers with accurate, timely assessments of their overall quality and efficiency will have the insights necessary to achieve success. While primary care visits make up approximately 5% of medical costs, specialty care drives 20-25% of total health care expenditures. Managing the cost and quality of specialty referrals can pay immediate dividends. Working with primary care providers to ensure they are utilizing specialists at the appropriate rate is one important factor, however ensuring that PCPs are referring to high-quality, high-efficiency specialists can be an even more effective strategy. Successful organizations must find ways to combine referral opportunity analyses with benchmarked specialist cost, quality, and efficiency analytics. Specialist provider performance benchmarks must be accurate, holistic, and fair—via case-mix adjustments for specialty-specific factors and the acuity, chronicity, and social determinants of each physician’s patient panel. While physician liaison and business development teams have always stressed the quality and value of their facilities and specialists, they have often lacked data-driven insights to support their case (or at least ones that stand the test of precision and fairness). Enabling front-line liaisons to engage in insight-driven conversations is a key step toward succeeding in today’s complex and highly competitive market. Strengthening alignment requires precise, case-mix adjusted specialist provider performance benchmarks and specialist referral pattern analytics. As hospitals, health systems, and other provider entities prepare to boost network integrity and drive higher-value referral decisions, they will increasingly need to rely on outside-in sources of data to assess provider referral patterns and performance beyond the four walls of their organizations. Electronic health record (EHR) data is too narrow to assess performance or to scan the market for opportunities. Traditional claims-based referral pattern analytics offer a window into what’s driving referral volume; however, they lack insight into referral quality. Health systems need the full picture. They need to know where each provider is driving referral volume and the quality and efficiency of the providers they’re referring to. With the latest release of Clarify Referrals, health systems can see just that. Clarify Referrals is a cloud-based software used by health systems to improve physician alignment and strengthen network integrity. It offers clear line of sight into what’s driving referral volume in and out of network while also delivering precise provider performance benchmarks. It assesses referral patterns in the terms that matter: volume and value. Even those organizations rightly focused on the financial success necessary to survive the headwinds facing providers today can benefit from the blending of cost, quality, and claims-based market insights as they strive to improve their business development and physician liaison functions. In an increasingly competitive market for provider referrals, all competitors claim they provide the greatest care proposition for a referring provider’s patients. Hospitals, health systems, and specialist groups seeking to attract those referrals must prove their case through demonstration of the quality and efficiency of care that they can provide. Success in any referral management program, across the entire continuum of payment transformation, and across all care settings begins with a clear picture of where an organization’s provider network stands today, where it needs to improve for tomorrow, and how it can best leverage its advantages in the marketplace. Whether in true VBC arrangements or in traditional FFS, simply analyzing quality data or claims data in a vacuum will miss the synergistic insights gained from combining quality, cost, and activity metrics in one holistic analysis.Network inclusion is as important as provider network integrity

Optimizing referral patterns

Strengthening physician alignment

The analytics needed to drive volume and value