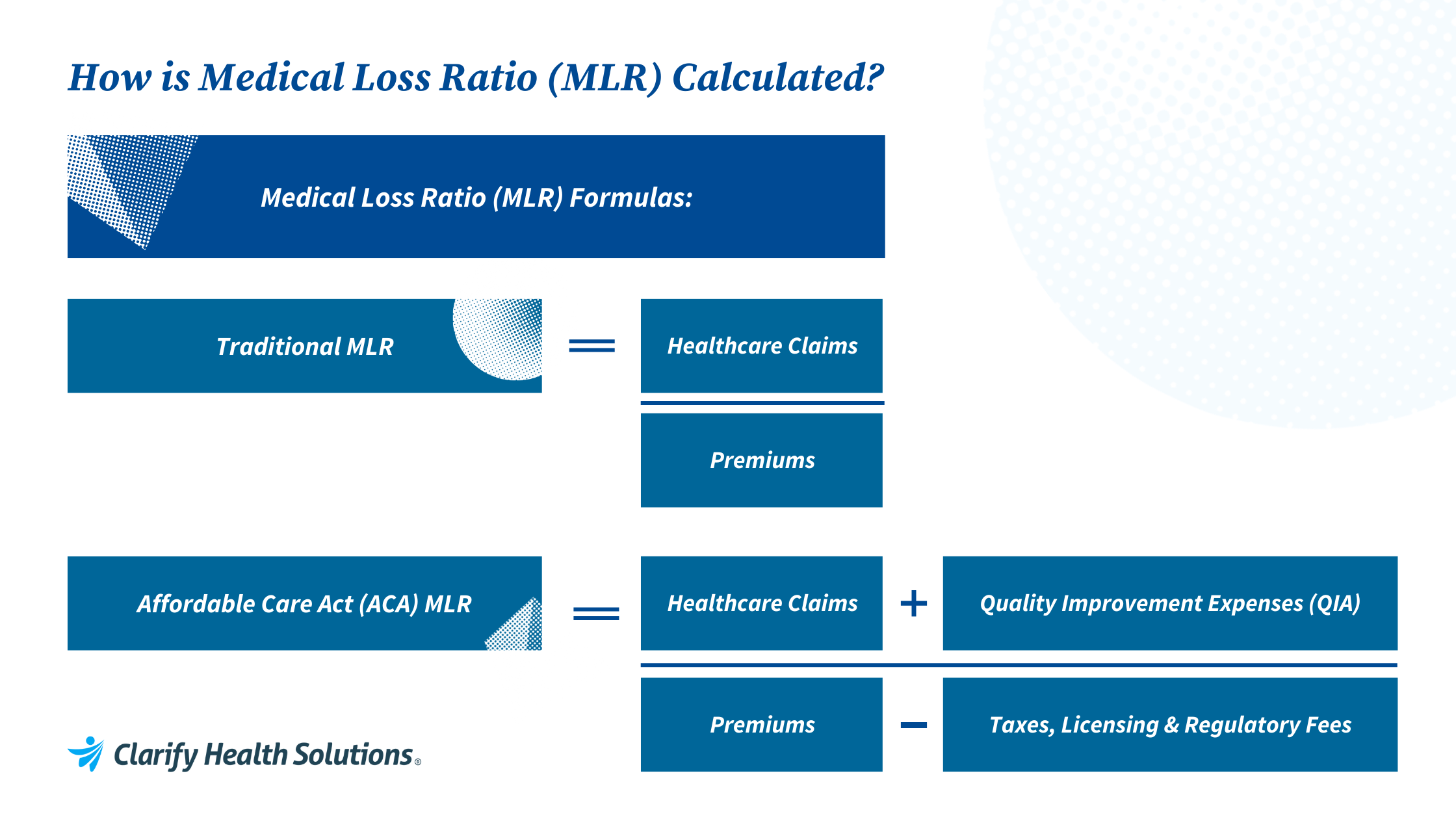

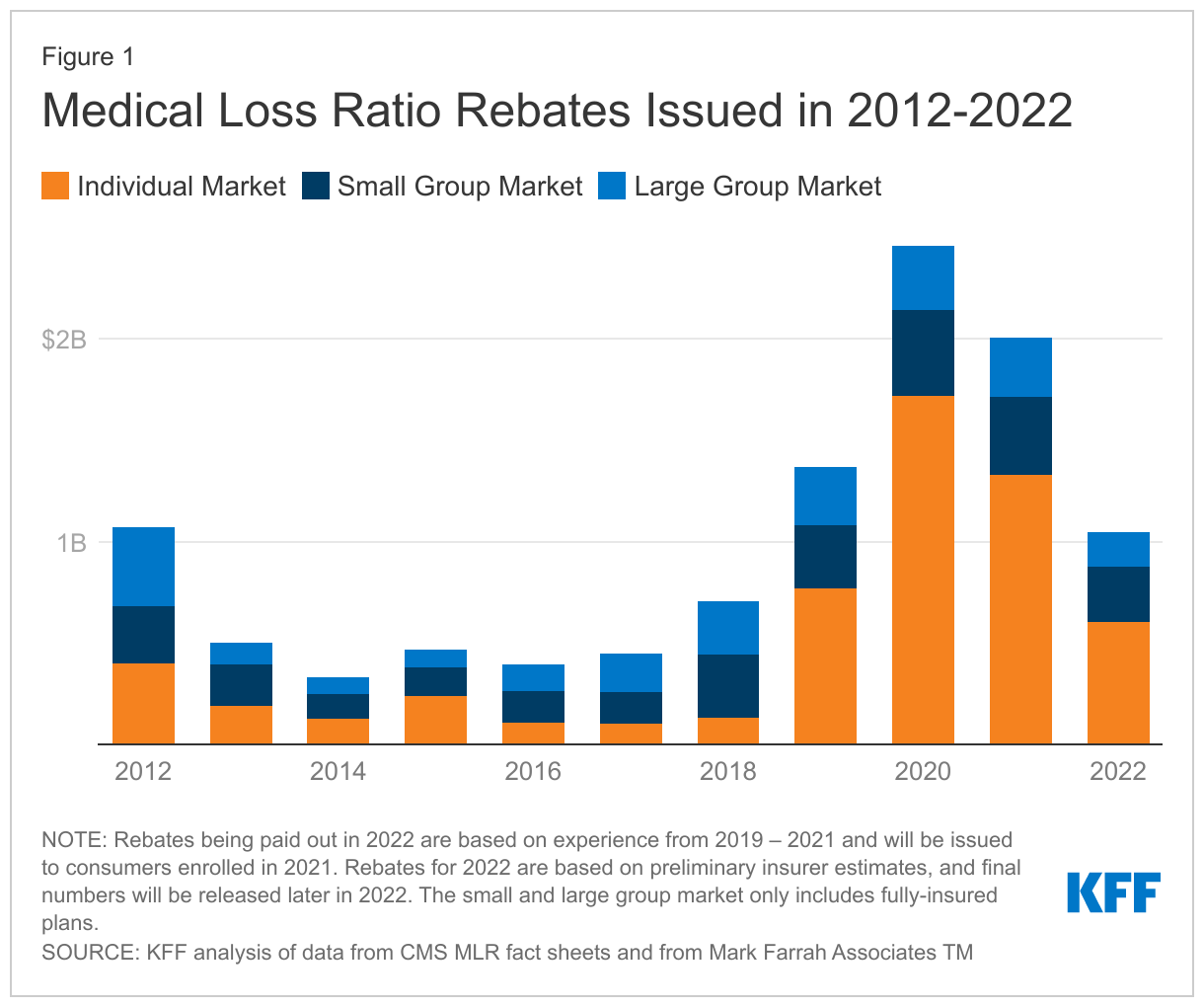

A core outcome of the 2010 passage of the Affordable Care Act (ACA) was to set in motion several formalized pillars of value-based care. From creating the first value-based care model (the ACO) to setting MLR targets for health plans to introducing penalties for organizations not meeting value standards for healthcare consumers, there are many seemingly basic mechanisms in place today that were novel just a decade ago. While it may not be a new concept, hitting MLR targets is critical to health plan profitability. In this blog, we’ll explore fresh approaches to optimizing MLR and driving true value for your members this year. But first… The medical loss ratio, abbreviated as MLR – also known as the medical cost ratio or MCR – is the percentage of member premiums that health insurers spend on medical care or quality improvement activities for their member population. Prior to 2010, when the Affordable Care Act (ACA) was passed, many health insurance payers spent a significant portion of their members’ premium dollars on administrative costs, marketing, and profits. Since the passage of the ACA, health plans are required to spend a minimum percentage of every premium dollar on clinical services and quality improvement. The medical loss ratio is calculated by dividing the total paid medical services claims plus quality improvement activities (QIA) by the total premium revenue minus the allowable deductions. (Paid medical services claims + QIA) / (Premium revenue – allowable deductions) = MLR For health insurers in the individual and small group markets, the standard MLR minimum for spending on quality improvement activities and medical care is 80%. For insurers in the large group market the MLR minimum is 85%. Health plans that do not meet these targets are penalized with increasing severity depending on the number of years a plan has missed their targets. Thanks to the Affordable Care Act, health plan customers will receive more value for their premium dollar because insurance companies will be required to spend $0.80 to $0.85 out of every $1.00 premium dollar on medical care and healthcare quality improvement, rather than on administrative costs. The COVID-19 pandemic presented many unforeseen challenges to meeting MLR targets in 2020. While health plans had already set their premium prices, several factors drove healthcare spending and utilization down. With hospitals deferring elective care at the start of the pandemic and many patients continuing to be uncomfortable with going into care facilities, health plan spending on patient care was cut dramatically. According to polling results shared from the Kaiser Family Foundation (KFF), nearly half of adults (48%) say they or someone in their household postponed or skipped medical care due to the coronavirus outbreak. This drastic decline in healthcare spending and utilization caused many health plans to miss their MLR targets for the year. KFF: Year-over-year growth in health services spending, Q1 2019 – Q4 2020 According to a report by Altarum, inflation-adjusted health care spending is falling for the first time in 60 years, signaling it may be harder than originally thought to recover MLR. As shown in the figure below, the effects of the pandemic continue to be felt, as rebates for 2022, 2023, and 2024 will include experience from the peak of COVID-19 and the years it’s taken to recover. MLR rebates are based on a 3-year average, so the 2022 rebates issued to people and businesses who bought health coverage in 2021 were calculated using health insurers’ financial data from 2019, 2020, and 2021. A Data Note issued by the KFF found payers would issue a total of about $1 billion in MLR rebates across all commercial markets in 2022. KFF Data Note: Medical Loss Ratio Rebates Issued in 2012-2022 After years of relatively flat premiums in the individual market, the KFF warns that the higher loss ratios seen in 2021 may cause steeper premium increases in 2023, as some insurers will aim for lower loss ratios to regain higher margins. The added pressure of higher inflation rates in the rest of the economy may result in increases in prices demanded by healthcare providers, and thus drive premiums even higher. As health plans work to get back to pre-COVID MLR targets, some common strategies may include finding ways to lower cost, investing more in managed care or utilization management programs, and ramping up value-based contracting. Optimizing MLR not just about price; it’s about the connection between price, quality, and patient experience. With this in mind, let’s explore three fresh strategies for optimizing MLR this year. With the right investments in data and analytics, you can support MLR initiatives by: Let’s take a closer look at each of these strategies. As the impact of the pandemic carries on, members may still face difficulties getting the care they need. Effectively managing population health requires getting members the care they need before an avoidable event occurs. Health plans should invest in a healthcare analytics platform that proactively identifies member risk and matches individuals to intervention programs that are best suited to meet their needs. In order to maximize ROI, health plans must be able to proactively prioritize interventions that will have the highest impact. For example, health plans may choose to enroll certain cohorts of members in additional engagement or care management programs to ensure they are staying healthy and active along their patient care journeys. Tracking performance of in-network and in-market providers is crucial for health plans both because these are important factors to CMS, but also because having a high-performing network means you are providing high-value services to your members. Health plans should prioritize contracting with high-value providers to include in their network based on case-mix adjusted clinical, quality, rate benchmarks, and cost-efficiency scores. Contract with providers in your market that can best meet the needs of your members with high-quality, low cost care, that is easy to access. Health plans can amplify the impact of a high-performing network by engaging in value-based contracts with those providers. Payers who are not ready for value-based contracts may consider setting up a provider incentive program to optimize site of service referrals to drive down costs and improve quality. A single point solution may be great for managing one program influencing MLR, but ultimately the best ROI will come from investing in a platform that can look across all lines of business and provide clinical, competitive, and strategic insights. Health plans can invest in enterprise analytics to bring all these data points together for a more complete picture of the factors influencing MLR and determine which quality improvement activities may yield the highest return for their members and their business. CMS created guidelines to encourage health plans managing government programs to invest in quality improvement activities (QIA or QI activities), particularly those that required investments in data and technology, which would ultimately improve the medical care that members receive. To be considered QIA, health improvement activities must lead to measurable improvements in patient outcomes or patient safety, prevent hospital readmissions, promote wellness, or enhance health information technology in a way that improves quality, transparency, or outcomes according to a KFF overview of components of the ACA-MLR equation. Examples of quality improvement initiatives that can be classified as quality improvement activities include: There are many unknowns coming out of the COVID-19 pandemic, but one thing we know for certain is that investment in technology that enables the identification and delivery of higher-value healthcare has never been more critical. The healthcare landscape is changing, government regulations are being re-written, and care models are being re-designed on the fly as we adapt, and plans need reliable, actionable analytics to ease these transitions. Investing in the right technology means investing in quality.What is MLR?

Challenges to hitting MLR targets in 2020 and the post-COVID era

![]()

Why is it taking so long to recover MLR?

Three steps to hitting your MLR targets this year

Identify and engage high-risk members

Track performance of providers in your market

Understand the value and performance of your provider network

Bonus MLR Strategy: Increase ROI by investing in tech-enabled quality improvement activities

What are Quality Improvement Activities (QIA) in healthcare?

Final thoughts on hitting MLR standards

- Author Details