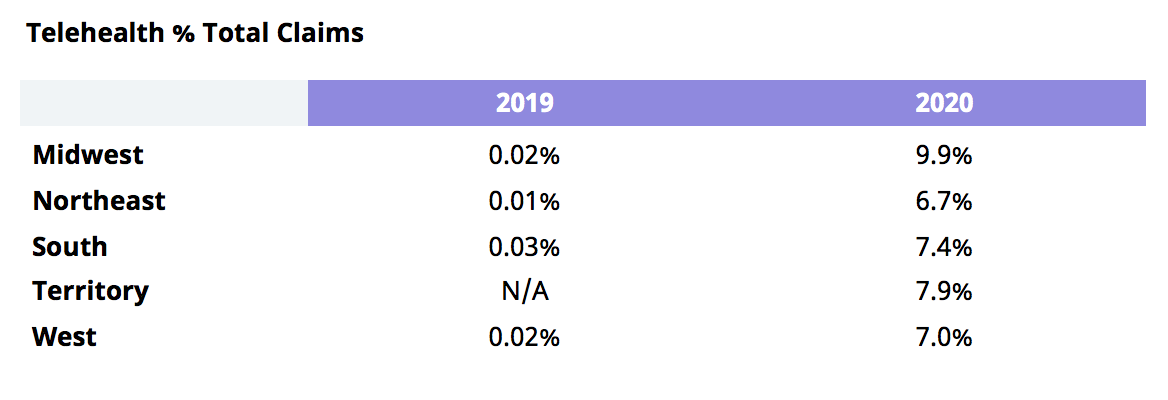

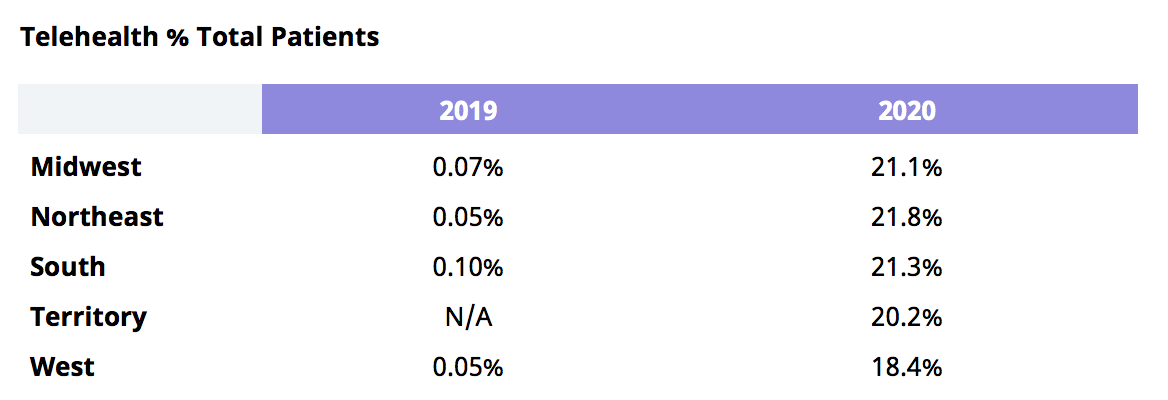

Much like how many consumers are turning to Amazon or Instacart delivery instead of in-store shopping during the pandemic, early data suggests that large swaths of the US population are choosing telehealth encounters instead of in-person visits with their healthcare providers. However, a key difference between the virtualization of services in healthcare and other industries is the complexity around healthcare data availability and useability to assess consumer trends. Understanding how patients are using telehealth is essential for our healthcare system to be able to optimize how it delivers care. Are elderly patients more or less likely than non-elderly patients to use telehealth? Are primary care visits more or less likely to be conducted virtually compared to specialist visits? And the questions only get more complex from there. This is why our research team started an initiative to uncover critical healthcare insights at the national, regional, facility, provider, and patient level. Our research leverages our comprehensive, proprietary datasets, covering over 300 million lives nationally. In this blog, we’ll share an initial analysis of commercial claims data for the period of March – May 2020. Our research reveals some exciting new information about the adoption of telehealth technology in the United States among commercially insured patients and provides early evidence of how the Covid-19 pandemic may have changed the provision and delivery of healthcare permanently. We first looked at overall utilization of telehealth services. It will not come as a surprise that we found a dramatic increase in telehealth utilization at the start of the Covid-19 pandemic. For the period of March – May 2020, telehealth commercial claims made up approximately 8% of all commercial claims nationally (non-prescription), which was a marked increase from the 0.02% rate observed for the same period in 2019. In some states, the observed rate went as high as 23%. Perhaps even more interestingly, approximately 20% (one in five) patients who received care during this period had at least one telehealth encounter, a dramatic increase over the 0.07% rate for the same period in 2019. Additional analyses revealed that the vast majority of these telehealth encounters were concentrated across a few key service lines. Behavioral Health (Medical) was the service line with the greatest percentage of patients transitioning to telehealth encounters, with 18% of mental health encounters occurring via telehealth, up from just 0.106% for the same period in 2019. Mental health encounters accounted for about 28% of all telehealth claims, holding steady with the approximately 31% share in the same period in the previous year. This finding is consistent with pre-pandemic patterns in the behavioral health service line, which has been an area of early adoption of telehealth services for the past few years. Other service lines with relatively high percentages of claims indicating telehealth utilization included Evaluation & Consultation services (6.5% of claims being telehealth) and Head & Neck Medical services (3.8% of claims being telehealth). These data indicate a trend towards increased adoption of telehealth as a site of service for physical evaluations too. However, health systems are skeptical about whether specialists will be able to accommodate tele-visits at the same rate as their primary care counterparts. At least at the start of the pandemic, primary care physicians were quicker to transition to telehealth while specialists generally had a more difficult time given the nature of their visits. The Midwest had 9.9% of commercial claims attributed to telehealth visits, more than any other region in the US. The South, West, and Northeast regions of the country all showed between 6.7% and 7.9% of claims as telehealth visits. All four major regions across the country showed that approximately 20% (one in five) patients receiving care had at least one telehealth encounter. This finding indicates that telehealth technology is becoming much more widely accessible to the population. Could telehealth be a new avenue for providers to increase traffic into their system? Between March and May 2020, 4% of telehealth encounters were new patient visits (i.e. those who had never been to an appointment with that health system before). The accessibility of virtual services means that some patients may be less concerned about their geographical proximity to the physical site of care when weighing their options. Thus, health system are actively considering telehealth as a means for attracting new patients as part of their 2021 strategies. Additionally, they will be looking closely at the impacts of telemedicine on patient loyalty. Many are taking a close look at the data from 2020 to see whether patients come back to their system or go elsewhere after a televisit and whether the no-show rate for televisits are any different than that of in-person, both signals of loyalty. If you are interested in using Clarify’s platform to understand telehealth trends in your market or want to learn more about our research and findings, contact us at [email protected].There was a 400-fold increase in telehealth encounters at the start of the pandemic.

Behavioral health services were delivered via telehealth more than any other specialty.

Access to care via telehealth is on the rise across all geographies.

New strategies for driving patient acquisition and loyalty

- Author Details